KUALA LUMPUR 12 Ogos - Trinity Group Sdn. Bhd. akan melancarkan projek kondominium baharu di Mont'Kiara, Trinity Pentamont dengan nilai pembangunan kasar (GDV) RM437 juta sebelum suku keempat tahun ini.

Pengarah Urusan Trinity Group, Datuk Neoh Soo Keat berkata, projek mewah mampu milik setinggi 41 tingkat itu akan dibina pada tanah berkeluasan 1.17 hektar dan dijangka siap sepenuhnya pada tahun 2022.

Kata beliau, Trinity Pentamont itu akan menyediakan sebanyak 330 unit kediaman iaitu 90 peratus daripadanya berkeluasan 2,057 kaki persegi, sementara 10 peratus lagi bersaiz 1,300 dan 4,000 kaki persegi.

"Terdapat permintaan tinggi di kawasan ini terutama daripada pasaran domestik dan selepas mula mempromosi, kami menjangkakan kadar ambilan akan mencapai 100 peratus dalam tempoh setahun bermula sekarang.

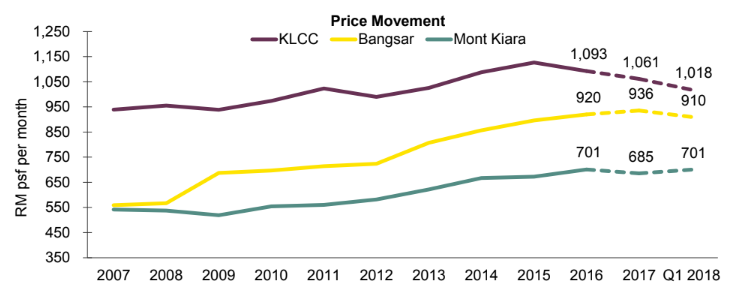

“Kediaman ini dijual pada harga RM600 setiap kaki persegi menjadikannya berharga RM1.25 hingga RM1.5 juta, lebih rendah berbanding harga pasaran kondominium di Mont’Kiara sekitar RM900 setiap kaki persegi," katanya kepada Utusan Malaysia di sini baru-baru ini.

Trinity Group merupakan syarikat pemaju hartanah butik yang ditubuhkan pada 2004 oleh Soo Keat sendiri dan sehingga kini mempunyai GDV dalam projek-projek terkumpul sebelum ini mencecah RM1.297 bilion.

la termasuk The Heron Residency, 19 Residency, The Zest di Kinrara, Latitude di Subang, The Z Residence, Zeva di Equine Selatan dan terbaharu Trinity Aquata di Sungai Besi dan Trinity Lemanja di Kepong.

Menurut Soo Keat, projek itu terletak di sepanjang Jalan Kiara 5 iaitu sebuah kawasan yang mewah selain berhampiran dengan pelbagai kemudahan gaya hidup seperti sekolah antarabangsa dan pusat membeli-belah.

“Terdapat pelanggan yang Iebih mementingkan kawasan contohnya walaupun terdapat rumah dengan harga mampu milik di Cheras, mereka Iebih cenderung untuk memilih kawasan di Petaling Jaya atau Mont’Kiara" kata beliau.

"Dengan keistimewaannya iaitu saiz yang besar, Trinity Pentamont ini akan memenuhi keperluan keluarga dengan kanak-kanak yang mampu untuk menjalani kehidupan harian dengan selesa dan selamat,” kata beliau.

Menurut Soo Keat, pasaran hartanah khususnya kediaman kini melalui tempoh peralihan ke arah yang Iebih positif kesan tahap keyakinan yang meningkat dengan kadar sifar cukai barang dan perkhidmatan (GST).

"Pasaran ini telah lemah sejak kebelakangan ini, jadi pembeli seharusnya mengambil peluang ini untuk membeli sebelum pasaran kembali meningkat kerana harga hartanah mungkin akan meningkat semula,” jelasnya.

KUALA LUMPUR - Trinity Group Sdn. Bhd. (Trinity Group) akan melancarkan projek kediaman mewah, Trinity Pentamont di Mont Kiara dekat sini pada Ogos 2018.

Pengarah Urusannya, Datuk Neoh Soo Keat berkata, kondominium yang melibatkan nilai pembangunan kasar (GDV) RM437 juta itu disasarkan kepada keluarga moden yang menginginkan kediaman berkualiti dan fleksibel yang bersesuaian dengan perubahan keperluan mereka.

"Setiap unit direka dengan mengetengahkan ruang seluas 191 meter persegi ke atas dengan rekaan dalaman yang bertujuan untuk mewujudkan pengalaman kehidupan yang kebiasaannya hanya boleh dinikmati oleh mereka yang mendiami rumah emper," katanya.

Beliau berkata demikian dalam satu taklimat media berkenaan projek tersebut bersama Pengerusi Eksekutif Savills (Malaysia) Sdn. Bhd., Datuk Christopher Boyd di sini baru-baru ini.

Menurut Soo Keat, Trinity Pentamont terdiri daripada 330 unit kediaman yang dibina di atas tanah seluas 1.2 hektar.

"Dijangka siap menjelang tahun 2022, kediaman tersebut dipercayai menarik pembeli yang menginginkan sebuah kediaman yang luas dengan lokasi strategik.

"Selain itu, dengan penawaran harga RM600 setiap kaki persegi, kami percaya ia suatu pembelian yang memberikan nilai berbaloi.

"Ini memandangkan tidak banyak hartanah, terutamanya di Mont Kiara, yang menawarkan harga tersebut bagi keluasan ruang yang kami tawarkan," ujarnya.

BUKIT JALIL: Despite alarming reports from (NAPIC) about the increase of 65% of unsold properties, the market isn’t as weak as speculated, said Savills Malaysia executive chairman Datuk Christopher Boyd.

Speaking last week at Trinity Office, he said that most of the units stock should not have been built in the first place. He believed that it is a normal process, considering that the overactive market had been caused by those who were over exuberant.

“This creates a mismatch between product and price, but it doesn’t categorise the whole market as a sector,” he said, adding that the population is growing just under 2% per annum, which on a world scale, translates to a high growth rate.

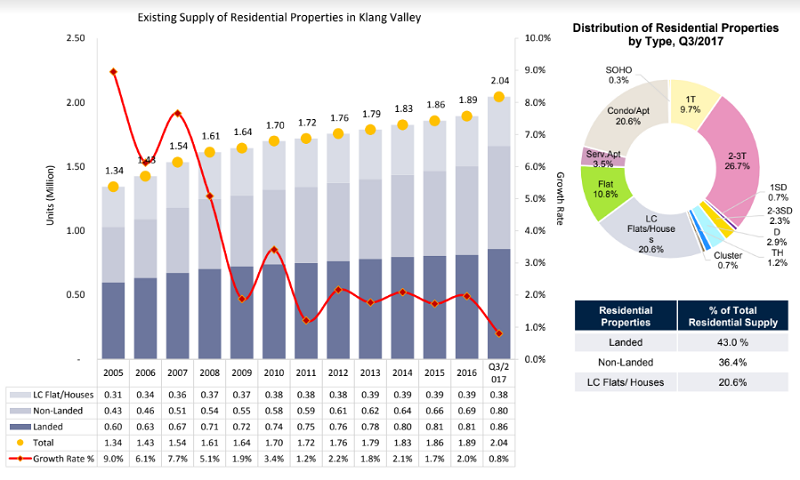

According to Christopher, during 2016 and last year, developers have been pumping up new supply at a rate of close to 8% per annum of existing supply. Despite a period of increase in value, developers have reacted by cutting down new supply in Greater KL to below 1% of the existing stock.

He also believed that the US and China trade war and the change in government had unsettled the market. However, with the Malaysian economy is growing with close to full employment, Christopher predicted that the existing overhang developments would be mopped up quite quickly in around a year and the price will pick up as demand grows.

As at the third quarter of last year, there were 2.04mil existing residential units in Greater KL, a growth of 7.9% from 1.89mil in previous year. This works out to just under four people per unit, down from seven or so in the mid-1970s.

Serviced apartments and SOHO constitutes the largest supply growth per annum, at 16.4% and 59.2%, respectively in the third quarter of last year.

Christopher said that with increase in land prices in the past decades, high-rise developments make up a greater proportion of the overall development, as it allows for the more efficient use of scarce land.

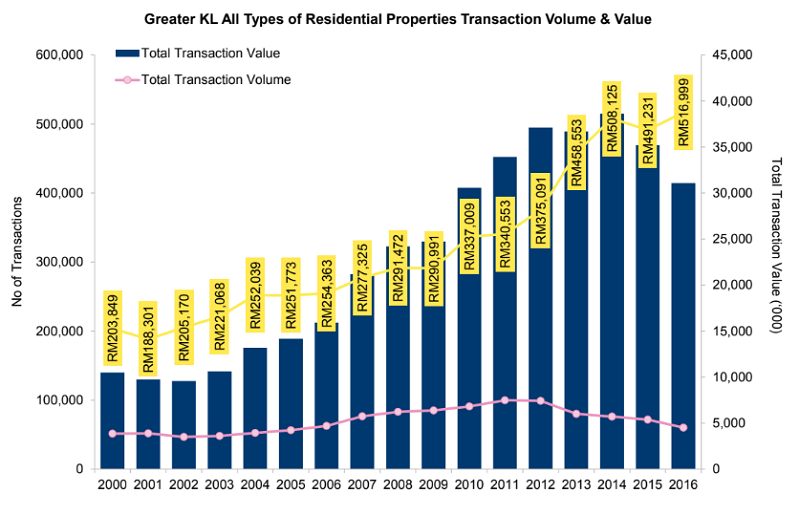

According to Christopher, the market from 2006 to 2012 was largely fueled by easy credit. This was the period when creative financing packages such as zero down-payment and the developer interest bearing scheme (DIBS) emerged.

As credit policies tightened in 2012, coupled with falling oil prices and global economic uncertainties, market activity was on a downward trend with total transactions as of the end of 2016 has declined by 25% since 2012.

However, the average value per transaction grew steadily despite the decrease in total market value, mostly due to inflationary pressure.

“We expected 2017 to be equally challenging for the property market as the large, new supply launched between the year 2013 to 2016, are added into the market.

“Nevertheless, it is unlikely that any product from the proposed redevelopment would hit the market before next year, allowing ample time for recovery,” said Christopher.

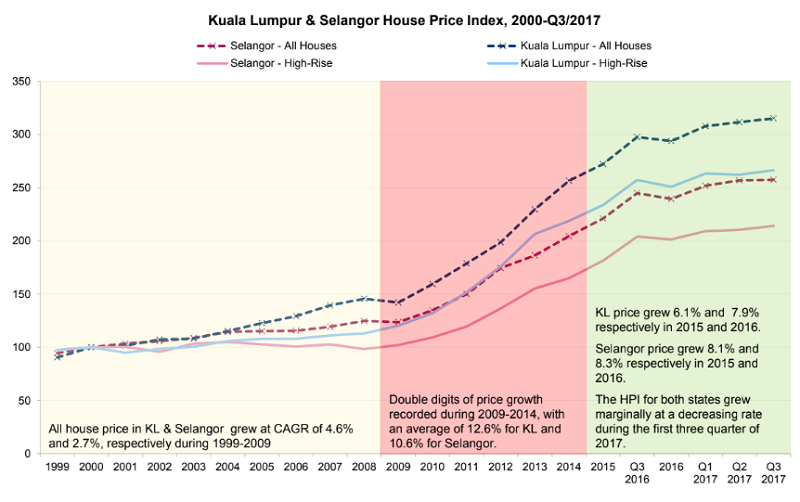

The index for all house prices in KL and Selangor grew at a double-digit rate of 10.6% and 12.6% between 2009 to 2014 respectively, despite global economic concerns. Even after a slowdown in 2015, price growth was still healthy, registering 7.9% and 8.3% in Kuala Lumpur and Selangor respectively during the year 2016.

Comparing third quarter of last year to the previous year, all house price index for Kuala Lumpur and Selangor indicated a growth of 5.9% and 5.1% respectively.

Christopher added that the Malaysian culture aids in the housing industry, saying that residential property ownership remains the most significant investment decision for most Malaysians during their lifetime.

As of 2016, Malaysia’s household debt-to-gross domestic product (GDP) fell to 88.4% from a record of 89.1% in the preceding year (87.9% in 2014). This is the first contraction since 2010. The ratio continues to decline to 84.3% in 2017, reflecting an economic upturn.

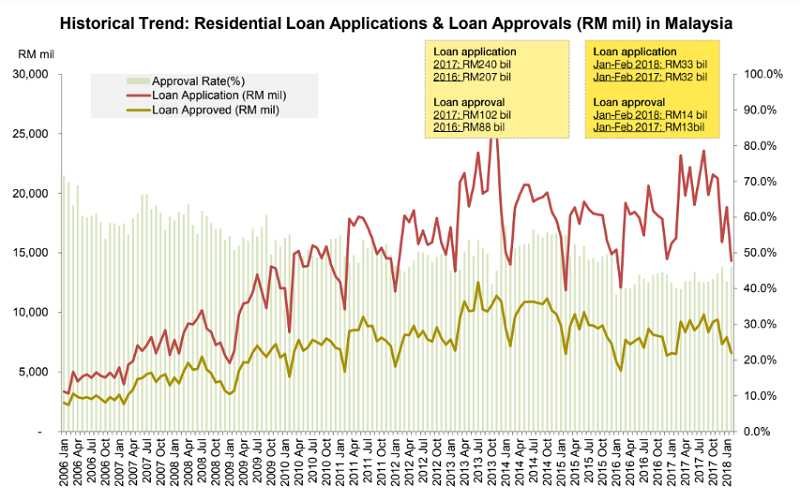

Residential loan applications in 2017 was at RM239.6bil, 15.6% higher than the previous year. The total amount of residential loans approved was at RM101.5bil, translating into an approval rate of 42.4%, which is 0.1% higher than 2016 (42.3%).

According to RAM Ratings, the overall loan growth for the banking sector will remain flat at about 5% to 6% in 2018. Christopher said that the residential property sector is expected to see a slow but gradual pick-up in market activity after the lull of the last several years.

Focusing on the Mont Kiara area, he also commented on the upward price movement in quarter one for 2018, which had increased by 2.3%.

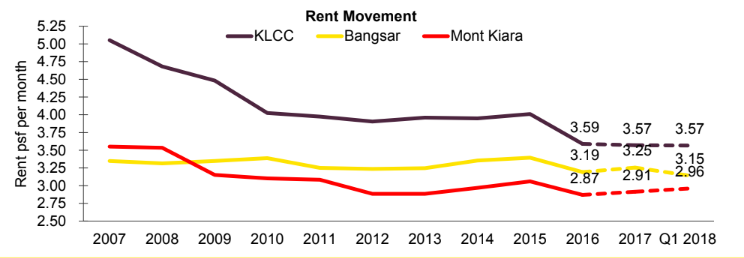

“Rentals for Mont Kiara remained stable as they offer diversity in terms of facilities, design concepts and price points which allow them to cater to different tenants,” he said, adding that Mont Kiara is very established in the city, with its proximity to fantastic convention and exhibition centres, as well as the high court. Christopher said it is worth noting that rents vary depending on the age of the property, location and other aspects such as it being furnished or unfurnished, as well as the facilities and amenities nearby.

On another note, Trinity Group managing director Dato TPr Neoh Soo Keat is proud to unveil the company’s latest development, Trinity Pentamont, a condominium composed of 330 residential units in Mont Kiara. Sitting on 2.9 acres of land, the freehold development with a total gross development value of RM437mil is expected to be launched during the third quarter of 2018. The starting price for Trinity Pentamont is at RM600 per sq ft.

TRINITY Group Sdn Bhd is marching on with its plan to launch 330 units of condominiums in Mont Kiara, Kuala Lumpur, by the third quarter of this year (3Q18) despite the slower market that has caused some property developers to defer their launches to 2019.

Trinity MD Datuk Neoh Soo Keat said with its gross development value (GDV) of RM437 million, Trinity Pentamont is expected to achieve a 100% take-up rate within six months after the launch.

"The latest condominium launch in Mont Kiara was in 2016 and all of the units had already been taken up. So, there is a high demand in the area, especially from the domestic market.

"We are selling the units from RM600 per sq ft, while the market price for condominiums in Mont Kiara is about RM800 to RM900 per sq ft. So, our early buyers will definitely have a better margin once the development is fully completed," Neoh told The Malaysian Reserve in an interview. The 1.17ha project's soft launch is expected to be in early August, while its completion date is in 2022.

Neoh said the company's other projects include Trinity Aquata, which is expected to be completed in 3Q18.

He said Trinity Aquata is now left with a few odd units, while the latest launched Trinity Lemanja has achieved an 85% take-up rate to date.

He added that Trinity has seen a steady revenue growth of almost 100% in the past two years due to the company's success in rolling out new product ideas that keep the Trinity brand ahead of the competition.

"Being a small and nimble company has its advantages. This means that we are agile and able to move faster than some of the bigger boys in the marketplace.

"Feedback and insights from our customers can quickly be turned into opportunities for the company to create innovative offerings that deliver affordable luxury for our customers," Neoh said.

Meanwhile, Trinity chief marketing officer CY Ng said the company has seen an increase in customer visits to the sales gallery following the zero-rated Goods and Services Tax implementation.

"Right after the appointment of the new government, we have seen a lot of customer walk-ins to our sales gallery. But then again, there is uncertainty in terms of infrastructure, so a lot of buyers are adapting a wait-and-see attitude.

"Surely and slowly the buyers' confidence will improve, especially for the mid-income segment — for example, our Trinity Lemanja in Kepong.

"It will become better when there is certainty because there is a lot of pent-up demand," she added.

PETALING JAYA (April 27): Property developer Trinity Group Sdn Bhd will be launching its latest condominium project in Mont’Kiara, Kuala Lumpur called Trinity Pentamont in 3Q18.

According to the group’s founder and managing director Datuk Neoh Soo Keat, the new project is named Pentamont because every unit in the development is like a penthouse and the name is a combination of the words “penthouse” and “Mont’Kiara”.

“Each of the 330 units will have a built-up of 2,057 sq ft and comes with three car park bays. There will also be six units in the development with sizes up to 4,000 sq ft, offering six car parks each,” Neoh told EdgeProp.my.

Unit prices start from RM600 psf, which translates into RM1.2 million to RM1.5 million per unit. Sitting on a 2.9-acre freehold site, the 41-storey project has an estimated GDV of RM400 million. The project is targeted to be completed by 2022.

“The project is located along Jalan Kiara 5, a lush and quiet enclave with a community of expatriates. It is also just minutes away from the best amenities and lifestyle conveniences, including two prestigious international schools and four retail centres within a 5km radius,” Neoh shared.

Meanwhile, Trinity Group chief marketing officer C Y Ng shared that besides being close to Mont’Kiara International School, Garden International School, Plaza Mont’Kiara, Hartamas Shopping Centre and other malls, the project is also close to hospitals namely Global Doctors Hospital, KPJ Damansara Specialist Hospital and ParkCity Medical Centre, as well as leisure spots including the Kuala Lumpur Golf and Country Club, Bukit Kiara Equestrian Club and Royal Selangor Club.

“The project is accessible via several major highways, including the Damansara-Puchong Expressway, SPRINT Highway, New Klang Valley Expressway, Duta Ulu-Kelang Expressway (DUKE) and DUKE 2 Highway,” she added.

To ease traffic flow for its future residents, Neoh said there will be two entry points into the project namely via Jalan Kiara 5 and a temporary one at Jalan Kiara 3. “The main entrance will be via Jalan Kiara 5 because it is not as busy as Jalan Kiara 3,” he said.

With the large unit sizes, the project is aimed at families with children. “For a unit this size, you can fit in your family comfortably, where your kids and even elderly parents can stay together. The minimum number of rooms each unit has is four bedrooms.”

Most of the units are also dual-key units. “When parents send their children off to study abroad, they hope that eventually their kids will come back to stay with them in the future. The dual-key units offer separate entrances, should the children come home to stay and want more privacy,” Neoh explained. Out of the 330 units, 300 are dual-key types.

Neoh says that the dual-key units offer separate entrances, should the children come home to stay and want more privacy. (Photo by Low Yen Yeing/EdgeProp.my)

While the target market is mainly locals, foreign buyers can have their units fully furnished so they do not have to face difficulties in home renovation or to scout for furniture before they move in.

On the overhang of high-rise residential units in the market, Neoh said it could be due to too many developments being completed at the same time, thus the number of completed units goes up significantly. However, he believes that the supply will be absorbed as Malaysia’s population is still growing and the need for housing remains.

“Moving forward, our next development project would be in the Subang (USJ) area, focusing on the industrial segment. In 2019, the focus would be on a mixed development in Ampang,” he said.

The group currently has projects with a total GDV of about RM3.3 billion and a landbank of up to 40 acres for future development.